Your data without limitations

built for flexibility, designed for control

Fund operations evolve, and your system should adapt accordingly. Whether your fund is managed in-house, externally, or via a hybrid model, Quantium provides seamless integration, operational flexibility, and full data control and ownership, no matter how your set-up changes over time.

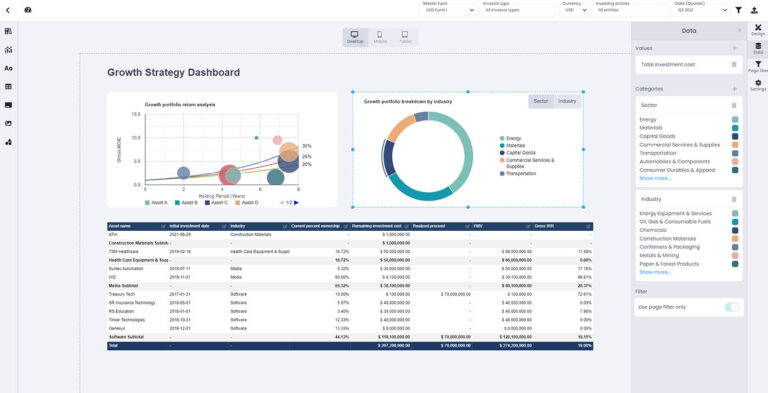

With Quantium, fund managers gain a holistic, cross-fund view of investment performance – ensuring LP relationships, fund exposures, and performance insights are always accessible. While many software solutions require ongoing report customization, Quantium provides a robust Business Intelligence tool with industry best-practice templates at no additional cost, allowing users to customize their reports efficiently.

With flexible in-source, co-source, and out-source workflows, multi-admin support, API integrations, and enterprise-grade reporting tools, Quantium empowers fund managers to own, analyze, and scale their data – without limitations.

features

- Direct Fund Admin Integration: Easily ingest fund admin data in their standard formats, whether through Excel templates or other accounting software. Supports single or multi-fund administrator setups, providing flexibility to change or switch fund admins without disruption.

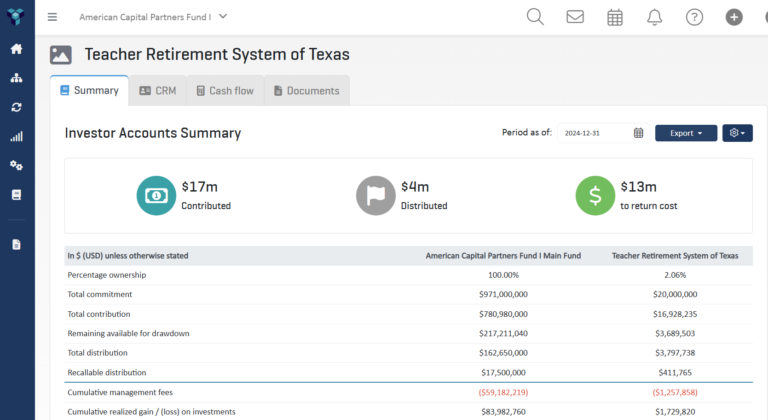

- Automated NAV & Capital Account Reconciliation: Eliminate manual reconciliations – Quantium automatically structures imported fund admin data, including cash flows, investor PCAP breakdowns, to match your records seamlessly.

- Cross-Check Only What Matters: Define specific data points to validate third party admin calculations – whether it’s NAV, carried interest or investor allocations – without recreating the entire workflow. Automate everything else, avoiding inefficiencies associated with traditional shadow accounting.

- Operate Directly on Quantium: Work with one of our fund administrators partners in the US, UK, EU, and Asia-Pacific who can manage fund accounting, reporting, and investor notices directly within Quantium. Data automatically synced with your investor portal and portfolio management modules.

- Administrator Access & Compliance: Maintain controlled access for your fund admin partners, ensuring they can operate efficiently while keeping you in full control of your data.

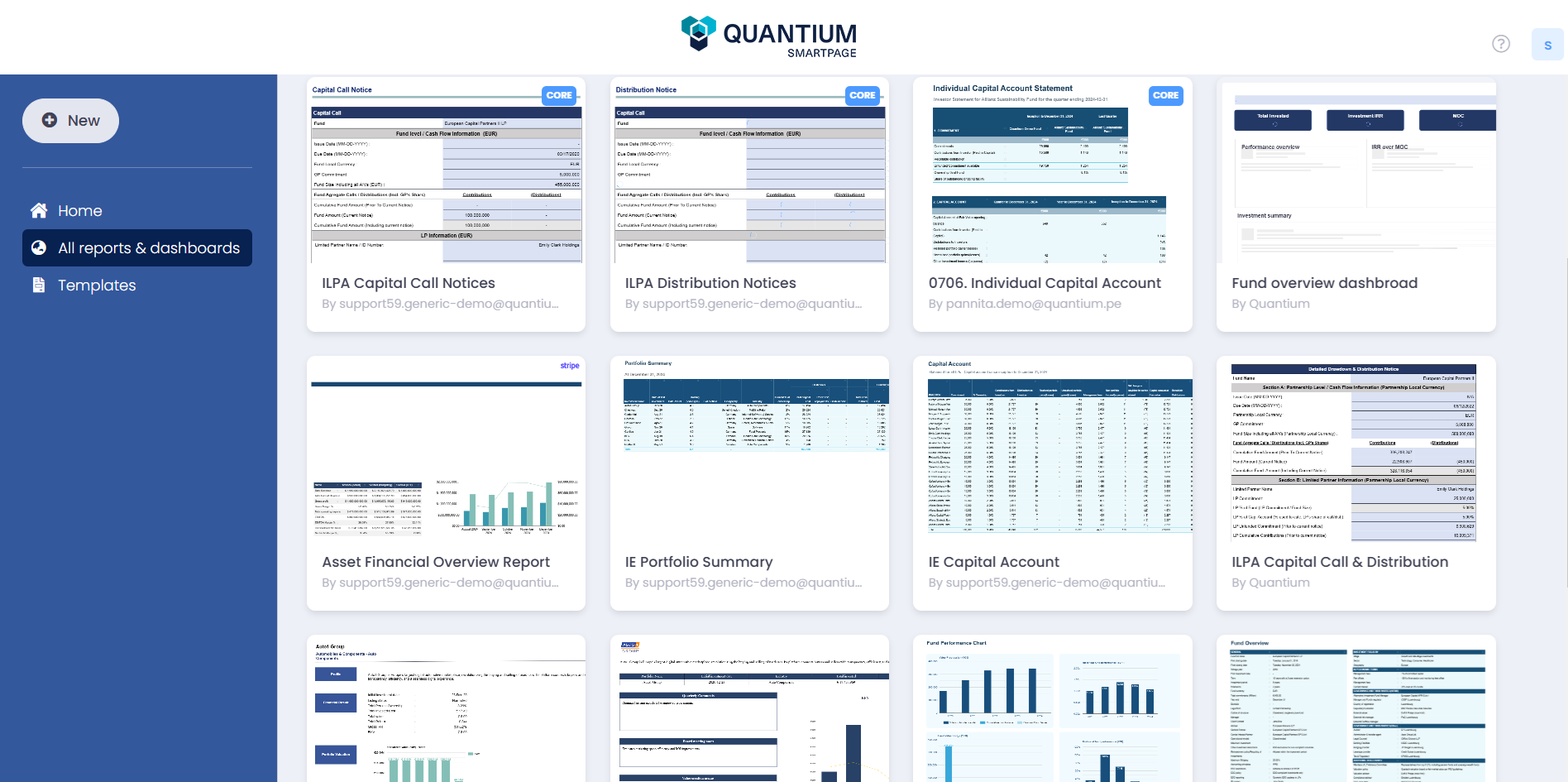

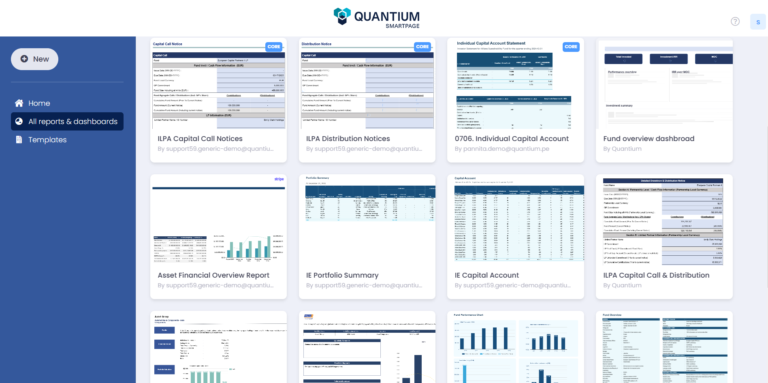

- Quantium’s BI & Report Builder: Generate custom fund reports, dashboards, and investor statements directly within Quantium’s BI platform.

- Best-Practice Templates at No Additional Cost: Utilize pre-configured reporting frameworks aligned with industry standards (ILPA, Invest Europe) while maintaining the flexibility to tailor reports to firm-specific requirements.

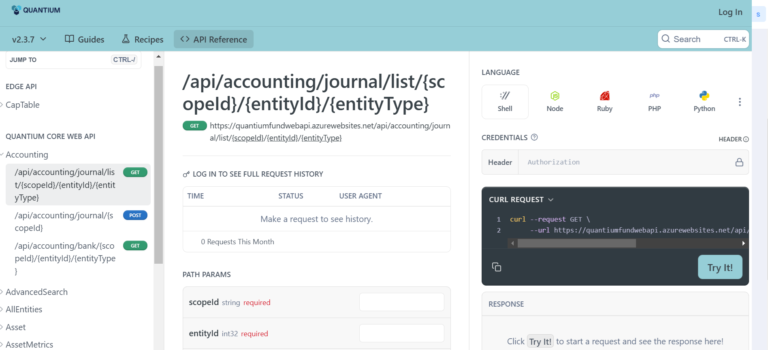

- API Integration: Eliminate data silos by integrating Quantium with your investor onboarding tools and other systems—ensuring smooth, end-to-end investor data flow.

- Enterprise Data Warehouse Compatibility: Direct integrations with Snowflake, Google BigQuery, and enterprise data warehouses enable firms to centralize fund performance analytics within broader investment data ecosystems.

use cases

From the first point of contact and throughout the implementation process, the Quantium team was exceptionally hands-on, proactive and agile. They impressed with their thoughtful questions about what ACE Alternatives was hoping to achieve – they know their business inside and out.

Matias Collan

Managing Director

ACE Alternatives

Send us your details via the form or e-mail us at enquiries@quantium.pe and our team will be in touch.