Automate workflows, maximize efficiency

manage investor positions & performance with ease

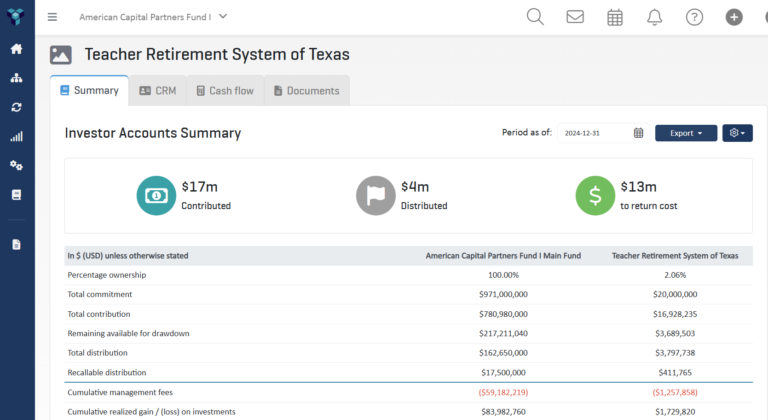

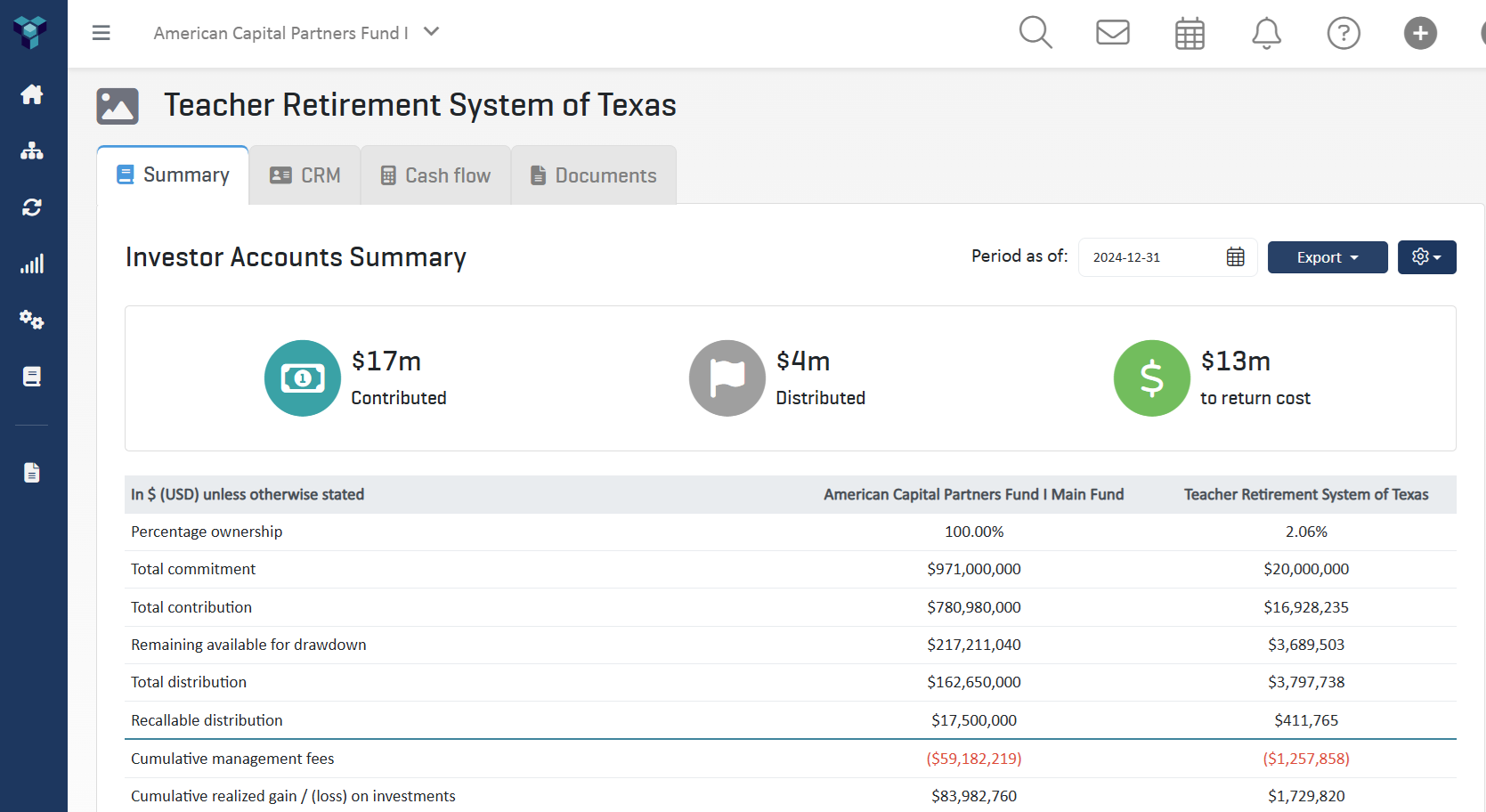

Managing investor workflows is a complex, time-sensitive process—but it doesn’t have to be. Quantium’s Investor Management module streamlines every step, automating capital call and distribution notices, simplifying waterfall and IRR calculations, and generating Partner Capital Account (PCAP) reports with ease. No more manual tracking or spreadsheet errors – just accurate, efficient fund operations.

Designed specifically for CFOs and finance teams, Quantium ensures precision while reducing tedious manual work. With built-in automation and real-time insights, you can focus on strategic decision-making instead of back-office tasks.

features

-

- Capital Call-Distribution Creation: Easily create capital calls in standard formats or your firm’s specific sub-account structures.

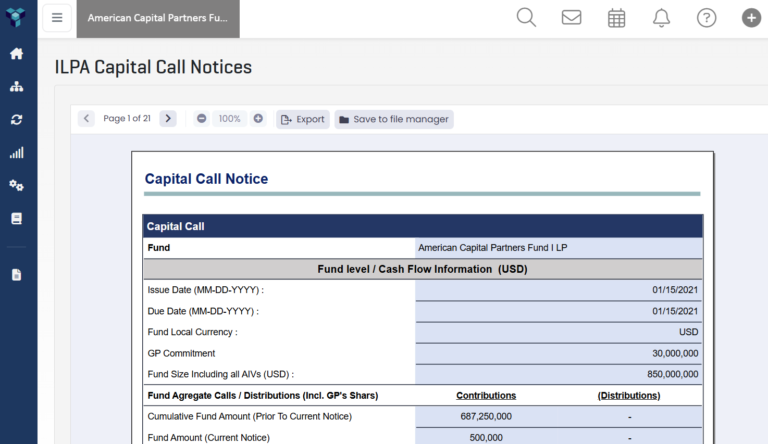

- Automated Capital Notices: Utilize Quantium’s ILPA and best-practice templates to automate capital call and distribution notices. Customize notices to reflect your brand logo and investor-specific bank account details accurately.

- Investor Allocation: Automate capital calls and distributions by sub-types with pre-defined allocation rules. Support advanced features like rounding to the nearest dollar and calls outside commitments to align with your firm’s policies.

- Commitment and LPA Tracking: Manage investor commitments and relationships across vehicles, tracking dollar-based or share-based commitments, management fees, and waterfall policies for specific side letters.

- Multiple Closings & Investor Transfers: Automate multiple closings and investor transfers, generating accurate PCAP balance reports before and after transfers.

-

-

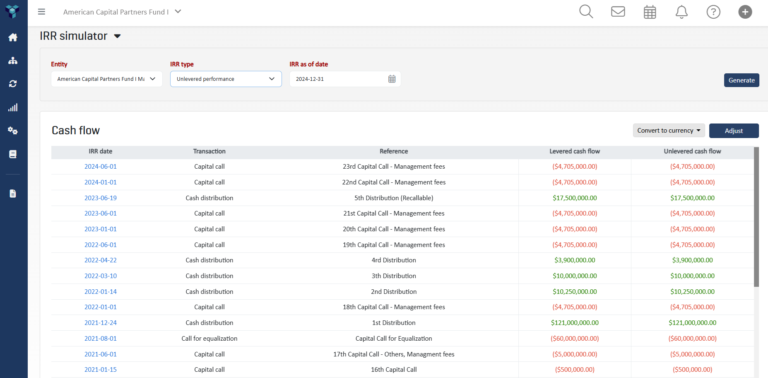

- Investor Level IRR: Automatically calculate IRR for individual investors based on capital calls, distributions, and NAV, as well as fund-level IRR across LP-GP, with or without GP positions included.

- Gross vs. Net IRR: Automate fund-wide Gross IRR (deal-only) and Net IRR (including/excluding carry).

- IRR Simulator: Run scenario simulations with variables such as FX rates and latest NAVs to map out potential IRR projections. Simulate leveraged vs. non-leveraged scenarios to assess their effect on IRR.

-

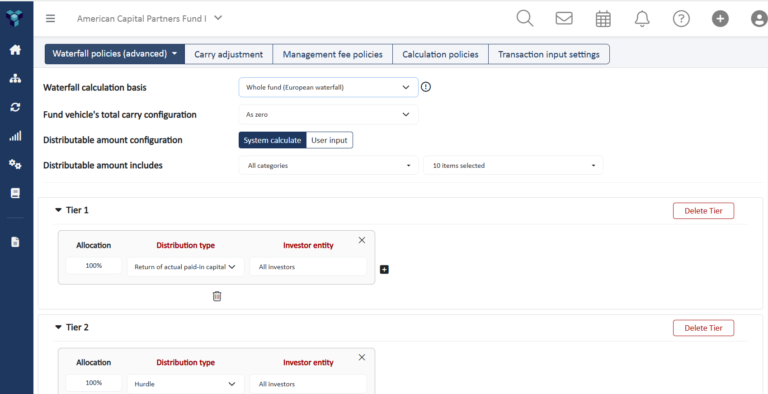

- European vs. American Waterfall: Automate accrued carry using standard European waterfall terms or American (deal-by-deal) waterfalls, with configurable carried interest percentages, GP catch-up policies, and more.

- LP-Specific Terms: Tailor waterfalls to specific LP terms, calculating waterfall distributions for different groups, such as custom rates and preferential terms.

- Waterfall Simulator: Project distributions under various scenarios, enabling precise planning for payouts.

use cases

Quantium has transformed our fund management operations. We now have an effective means of tracking and presenting NAV and other key metrics, and our staff have provided excellent feedback on the usability and ease of use of the investor portal. We’re very pleased with the support we’ve received from the Quantium team, which has been impressive and effectively supported the implementation and ongoing improvement of our use of the platform.

Katsuya Baba

Chief Administration Officer

Advantage Partners

Send us your details via the form or e-mail us at enquiries@quantium.pe and our team will be in touch.