End-to-end loan management

built for modern private debt operations

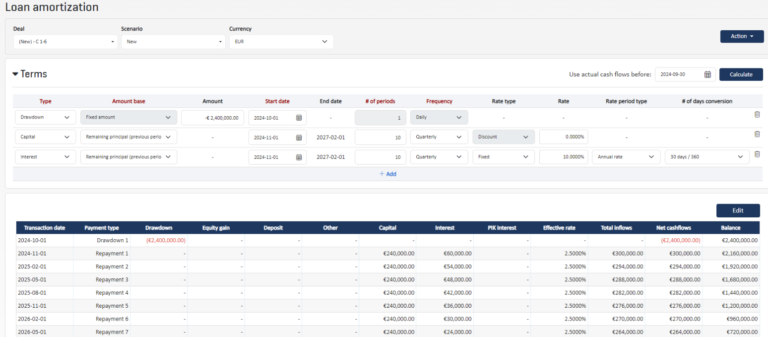

Managing private credit is complex. Your loan book evolves constantly – rate adjustments, restructurings, and fees demand a system that can keep up. Quantium is the answer; our software automates loan schedules, ensuring real-time updates, accurate cash flow tracking, and seamless banking integration.

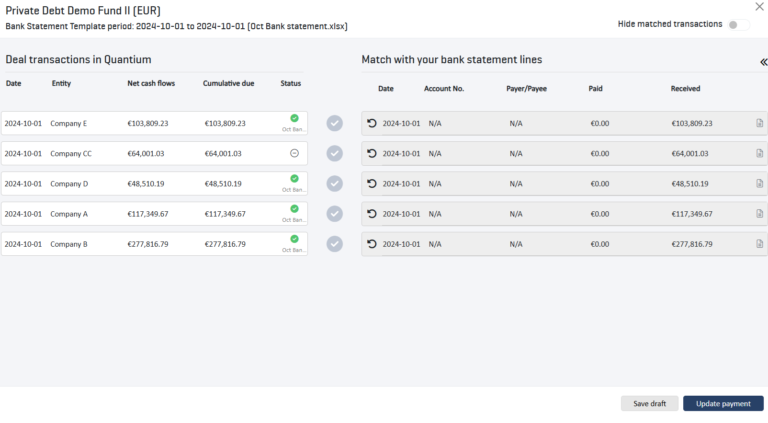

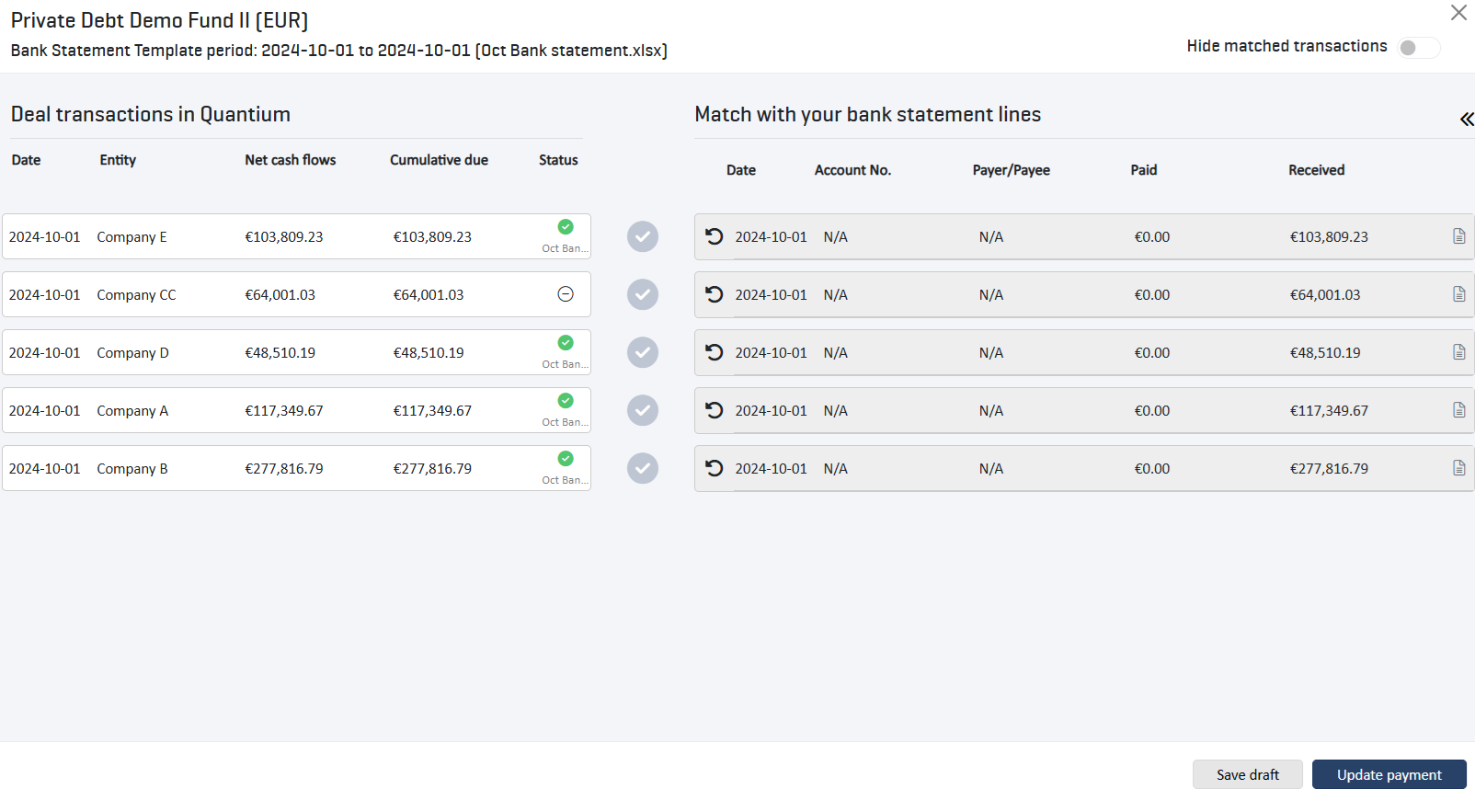

Cash flow accuracy depends on precise payment management and reconciliations. With direct bank feeds, automated transaction mapping, and structured workflows, Quantium eliminates the headache of manual tracking, reducing errors and efficiencies.

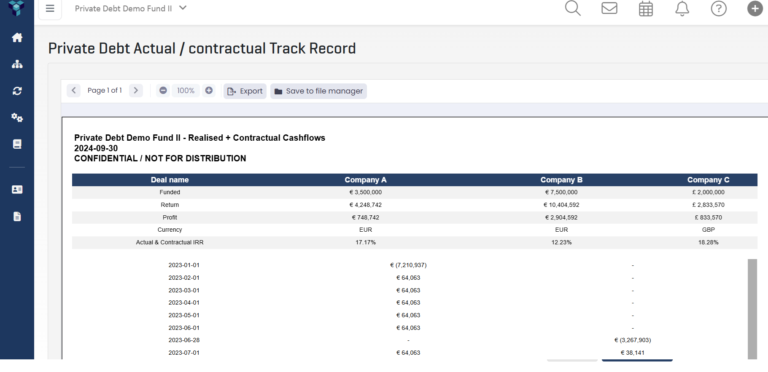

Beyond the standard metrics, it’s important to have contractual and actual vs. contractual performance insights to support holistic reporting. Quantium automates performance tracking across the loan lifecycle, giving fund managers greater accuracy, reduced risk, and easy investor reporting.

features

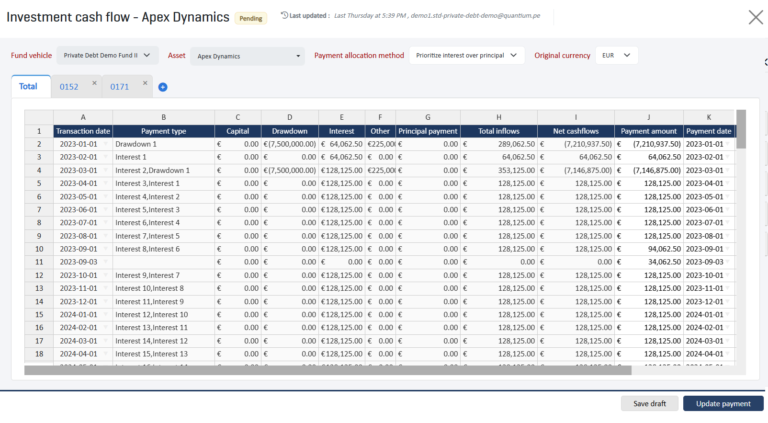

- Automate Loan Schedules: Generate scheduled cash flows based on loan terms.

- Support for Restructuring & Modifications: Adjust loan maturity dates, payment-in-kind (PIK) structures, and principal repayments as terms evolve.

- Interest Rate Adjustments & Benchmark Rate Tracking: Support SOFR, SONIA, Euribor, and other floating rates, automatically applying rate changes to loan schedules.

- Multi-Currency & Day Count Conventions: Configure daily, monthly, and quarterly compounding with 30/360, actual/360, and actual/actual calculations to align with loan agreements.

- Track Loan Performance Across Stages: Compare contractual cash flows, interim calculations, and actual vs. projected loan performance.

- Automated IRR & Yield Calculations: Compute realized vs. expected IRR, helping managers assess profitability and loan portfolio health.

- Break Down Cash Flow Components: Separate principal repayments, interest accruals, fees, and prepayments for clear performance insights.

- Investor-Level Performance Allocation: Allocate realized cash flows and interest income to investors at both fund and individual position levels.

- Automate Loan Payment Processing: Allocate incoming payments across multiple loan tranches, ensuring structured principal and interest reconciliation.

- Configurable Payment Allocation Rules: Set custom allocation priorities, including applying payments to interest before principal or following structured waterfall sequences.

- Track Late Payments & Accrued Interest: Ensure accurate interest accruals and overdue balance tracking.

- Direct Integration with 1,000+ Banks: Automatically sync payments and reconcile loan transactions across EU, UK, and North American banks.

- Real-Time Loan Repayment Matching: Map incoming payments to loan schedules, reducing manual reconciliation errors.

- Seamless Fund NAV & Investor Account Sync: Ensure automated updates to fund NAV calculations, capital calls, and investor capital accounts.

use cases

It is vital for our team to have a single source of truth for portfolio, fund and investor data. Quantium provides all of this and more, with toolkits to generate forecasts, performance dashboards, and investor reporting. We look forward to using Quantium to manage our portfolio more proactively, enhancing the integrity of our data and providing our LPs with best-in-class investor servicing.

Robert Uren

Fund Controller

Bootstrap Europe

Send us your details via the form or e-mail us at enquiries@quantium.pe and our team will be in touch.