Powerful private debt software

Automated loan schedules with real-time updates, precise cash flow tracking, and seamless banking integration.

Trusted by leading asset managers

features

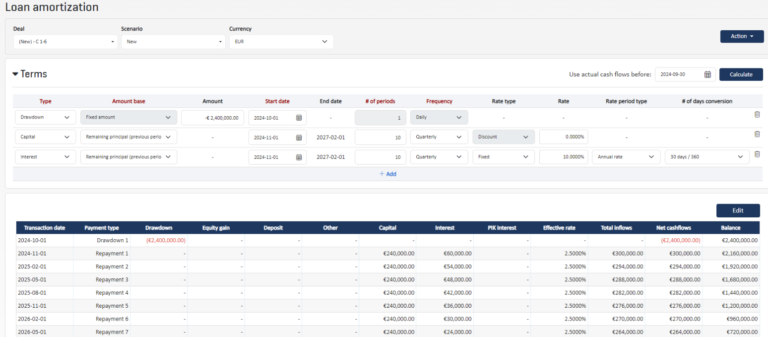

- Automate Loan Schedules: Generate scheduled cash flows based on loan terms.

- Support for Restructuring & Modifications: Adjust loan maturity dates, payment-in-kind (PIK) structures, and principal repayments as terms evolve.

- Interest Rate Adjustments & Benchmark Rate Tracking: Support SOFR, SONIA, Euribor, and other floating rates, automatically applying rate changes to loan schedules.

- Multi-Currency & Day Count Conventions: Configure daily, monthly, and quarterly compounding with 30/360, actual/360, and actual/actual calculations to align with loan agreements.

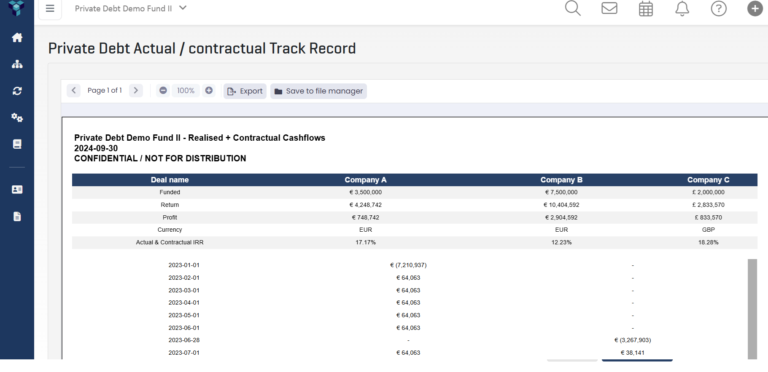

- Track Loan Performance Across Stages: Compare contractual cash flows, interim calculations, and actual vs. projected loan performance.

- Automated IRR & Yield Calculations: Compute realized vs. expected IRR, helping managers assess profitability and loan portfolio health.

- Break Down Cash Flow Components: Separate principal repayments, interest accruals, fees, and prepayments for clear performance insights.

- Investor-Level Performance Allocation: Allocate realized cash flows and interest income to investors at both fund and individual position levels.

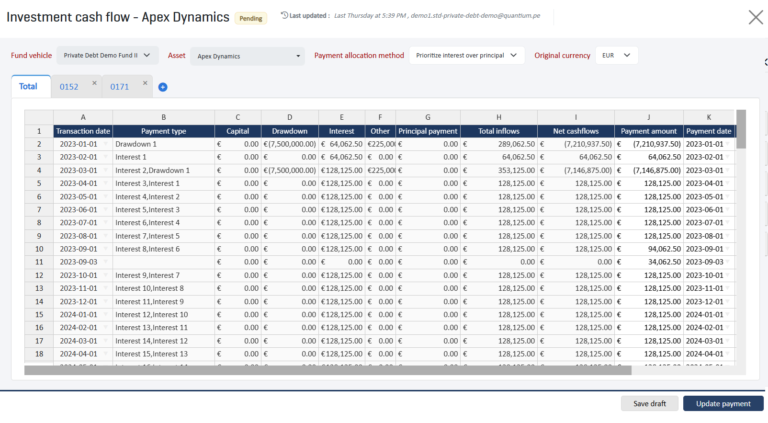

- Automate Loan Payment Processing: Allocate incoming payments across multiple loan tranches, ensuring structured principal and interest reconciliation.

- Configurable Payment Allocation Rules: Set custom allocation priorities, including applying payments to interest before principal or following structured waterfall sequences.

- Track Late Payments & Accrued Interest: Ensure accurate interest accruals and overdue balance tracking.

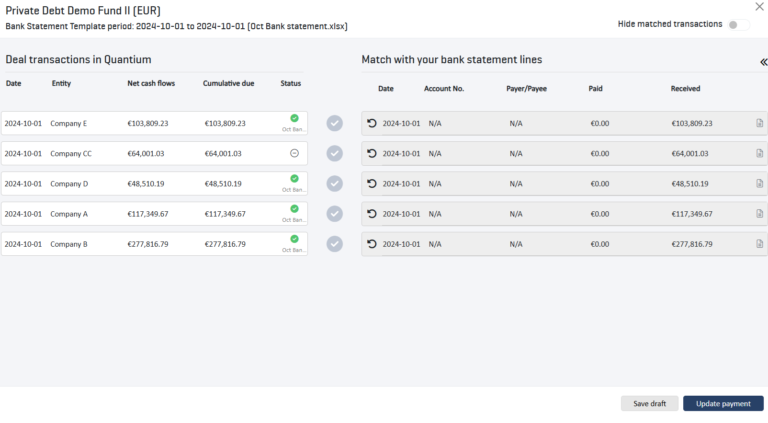

- Direct Integration with 1,000+ Banks: Automatically sync payments and reconcile loan transactions across EU, UK, and North American banks.

- Real-Time Loan Repayment Matching: Map incoming payments to loan schedules, reducing manual reconciliation errors.

- Seamless Fund NAV & Investor Account Sync: Ensure automated updates to fund NAV calculations, capital calls, and investor capital accounts.

“Quantium’s excellent customer service and account management post-implementation have been outstanding. We also appreciate Quantium’s collaborative approach – we can rely on their team to give us the best advice, with quick responsiveness. It’s clear that they prioritize their customers, making us feel valued and at the center of their focus.”

“Quantium provides a highly effective and intuitive fund management platform. Its reporting tool, in particular, has been very helpful in streamlining data consolidation and various reporting generations with its flexible capabilities. We are also impressed by Quantium’s customer service teams with their focus on creating positive client experiences.”

“I am impressed by Quantium’s software. With extensive experience in implementing, migrating, and using top-tier PE tools in my roles as IT lead, fund administrator, and CFO at renowned German private equity firms, I found Quantium to be a thoughtfully designed, state-of-the-art system that meets the complex needs of private equity professionals.”

“Quantium gives us a single source of truth, with data that is clear, accessible, and up to date. The software is intuitive and feature-rich, and the flexible reporting tools have been very helpful in streamlining investor reporting. Beyond the system’s functionality, Quantium’s support has been excellent. They ensured a seamless transition from our previous solution and are responsive to any questions that come up. Overall, we have found Quantium to be an effective fund management solution and have had very positive experiences working with their team.”

“Quantium has transformed our fund management operations. We now have an effective means of tracking and presenting NAV and other key metrics, and our staff have provided excellent feedback on the usability and ease of use of the investor portal. We’ve been very pleased with the level of support we’ve received from the Quantium team, which has been very impressive and has effectively supported the implementation and ongoing improvement of our use of the platform.”

“Our team is no longer slowed down by endless spreadsheets and complex manual calculations. Quantium has truly digitised our previously manual investment operations by automating the majority of these processes. We can analyse investment information with ease, generate reports in a few clicks, and access our investor information instantly whenever we need it.”

“With Quantium, we have a single source of truth for our fund management workflows, including shadow accounting to cross-check our fund admin’s data and post-investment management. Quantium has also automated our investor reporting, which allows our team to focus on high-value tasks. We are extremely impressed with the smooth implementation process at Quantium as well as the system itself.”

“Quantium’s data analytics and strategy solutions are top-notch. They provide deep insights that help us make quick, informed decisions and save us valuable time by automating tedious data analysis tasks. Highly recommended!”

“From the first point of contact and throughout the implementation process, the Quantium team was exceptionally hands-on, proactive and agile. They impressed with their thoughtful questions about what ACE Alternatives was hoping to achieve – they know their business inside and out.”

“Quantium is an integral part of Golden Gate’s operations, providing us with easy, accessible fund and portfolio data as well as actionable insights through their portfolio monitoring services. Their team’s expertise in how LPs monitor and evaluate investments makes them an ideal operating partner for high-performing venture firms. The team has also been extremely helpful in customizing the platform to make sure it suits the specific needs of our firm.”

Send us your details via the form or e-mail us at enquiries@quantium.pe and our team will be in touch.