Built by CFOs, for CFOs

dual-sided accounting for private markets

A powerful dual-sided accounting solution designed to simplify even the most complex fund accounting processes. Carefully designed by CFOs for CFOs, Quantium empowers private market fund accountants around the world to manage their funds accurately and efficiently. Our award-winning Fund Accounting module simplifies even the most complex accounting tasks, enabling you to manage your funds with unparalleled precision and ease.

features

- Automated Accounting Processes: Streamline the accounting ledger for frequent transactions such as capital calls, management fees, and valuation updates.

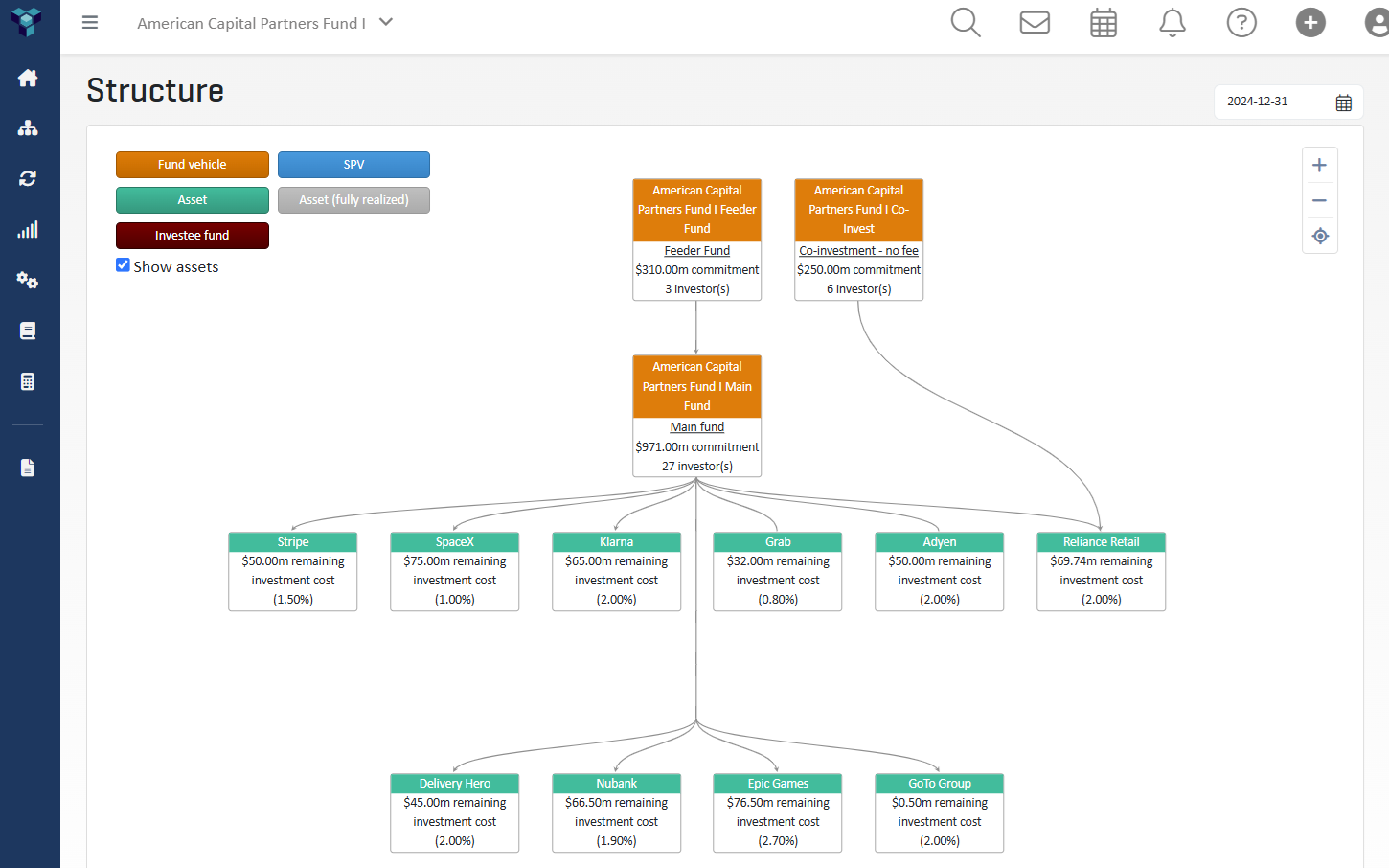

- Complex Structures: Automate accounting for sophisticated structures like feeder/main funds and blockers. Quantium automates equity pick-ups, intercompany cash flow, and consolidation.

- Dynamic Investor Allocation: Efficiently manage investor allocations, from simple setups to complex deal opt-outs. Support for automation of commitment transfers, multiple closings and more.

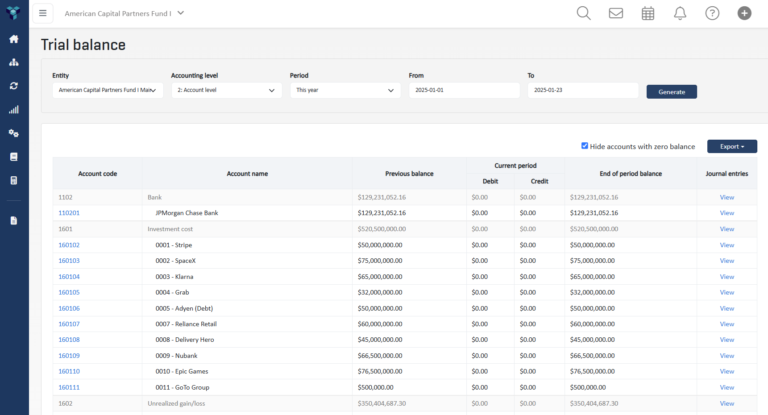

- Customizable Chart of Accounts: Use Quantium’s out-of-the-box chart of accounts (supporting IFRS/GAAP), or customize account codes and groupings for specific vehicles or firm-wide reporting needs.

- Comprehensive General Ledger & Trial Balance: Access a flexible general ledger and trial balance with group vs. drill-down and filtering options.

- Equity, Loan & Fund Investments: Track direct equity and credit instruments, along with support for fund investments, including primary and secondary fund commitments.

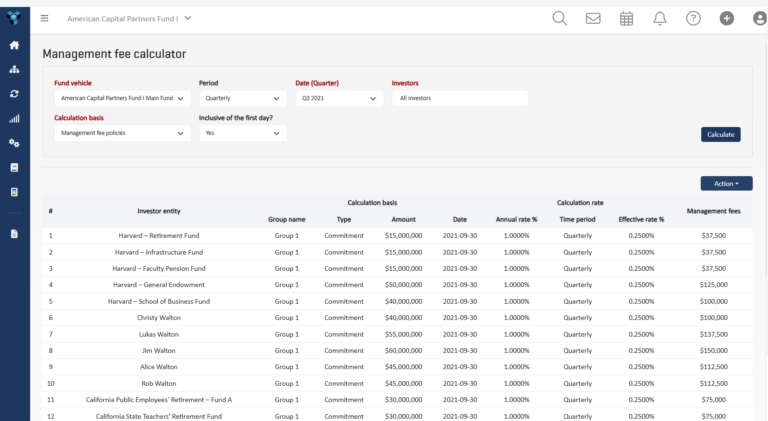

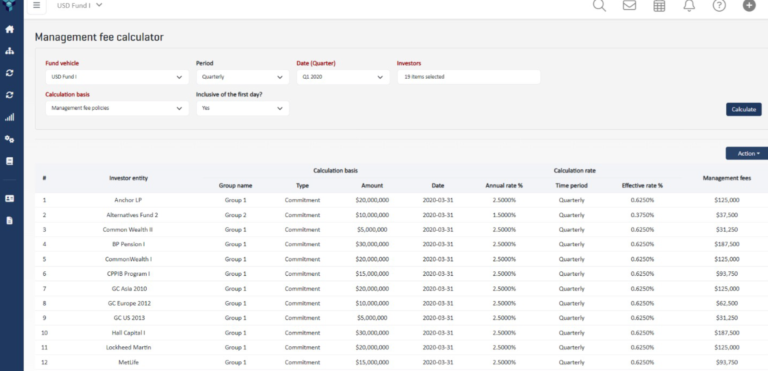

- Management Fee Calculator: Automatically calculate management fees based on flexible rules and discounts. Set up specific rules for different investors based on your LPA and Side Letters.

- M&A and Share Distribution Toolkit: Support complex transactions like loan conversions, stock splits, share distributions and M&A events such as mergers and spin-offs.

- Simplified Reconciliation: Use advanced drill-down functionality to view investor allocations by transaction. Support both single-layer and ultimate LP allocations, simplifying the PACP reconciliation process.

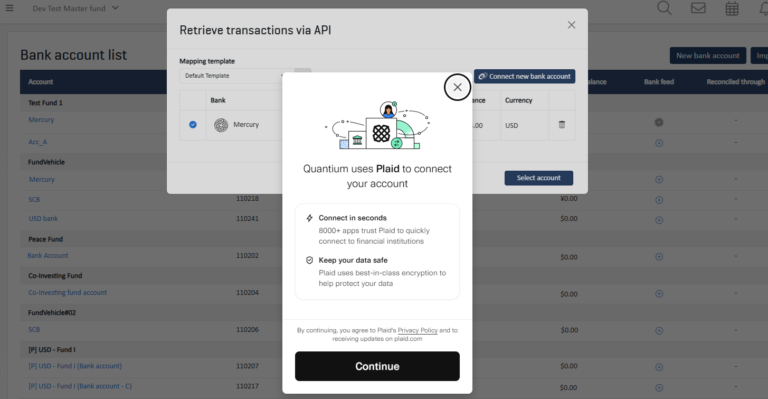

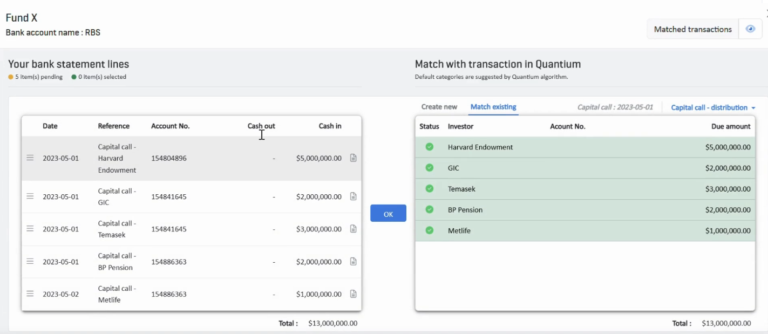

- Bank Integration: Integrate directly with thousands of banks via API, automating frequent journal entries (e.g., bank fees) and capital call matching, significantly reducing manual processes.

- FX Automation: Automate foreign exchange (FX) investment and fund operations transactions with real-time rates via API from the European Central Bank.

- Accounting Approvals and Workflows: Implement multi-layered approval workflows, ensuring compliance and smooth book closures for your vehicles.

use cases

Our team is no longer slowed down by endless spreadsheets and complex manual calculations. Quantium has truly digitised our previously manual investment operations by automating the majority of these processes. We can analyse investment data with ease, generate reports in a few clicks, and access our investor information instantly whenever we need it.

Sébastien Thiel

Partner and CFO

Smartfin

Send us your details via the form or e-mail us at enquiries@quantium.pe and our team will be in touch.