Simplified, real-time tracking

the all-in-one solution for modern limited partners

Managing a fund-of-funds portfolio requires full transparency into cash flows, performance tracking, and exposure analysis – but legacy systems often fall short, struggling with complex fund structures, secondary transactions, and look-through asset visibility.

Built by a team of former LPs and CFOs, Quantium is designed specifically for institutional investors, offering real-time portfolio tracking, automated cash flow management, and in-depth performance analytics. With full flexibility across primary and secondary investments, Quantium ensures every commitment, distribution, and NAV adjustment is seamlessly captured, enhancing decision-making and operational efficiency.

features

- Track All Primary Positions: Including cash flows, NAV, and key fund and management company details.

- Monitor Capital Calls and Distributions in Real Time: Ensuring accurate tracking of performance metrics and valuation updates.

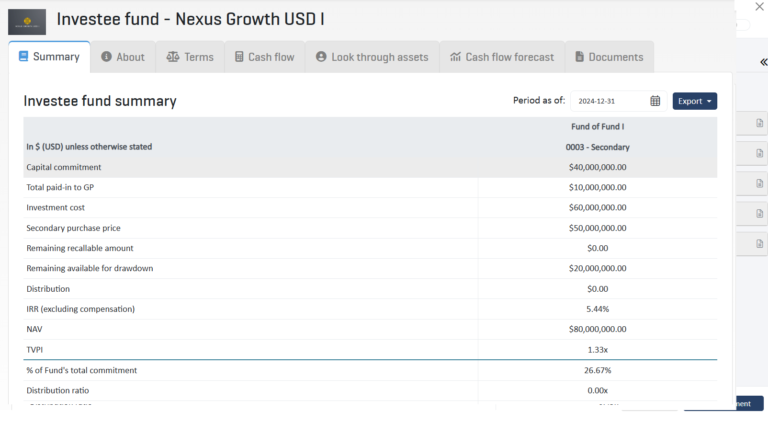

- Analyze Investee Fund Performance Across Multiple Investments: Providing a consolidated view of remaining commitments, returns, and portfolio positions.

- Track Purchase Price, original LP’s commitment, cumulative paid-in capital, and cumulative distributions.

- Automate Premium/Discount Calculations and purchase price-to-cost ratio analysis based on transaction details.

- Monitor Unfunded Exposure, liquidity planning, and expected distributions, optimizing portfolio liquidity and exit strategies.

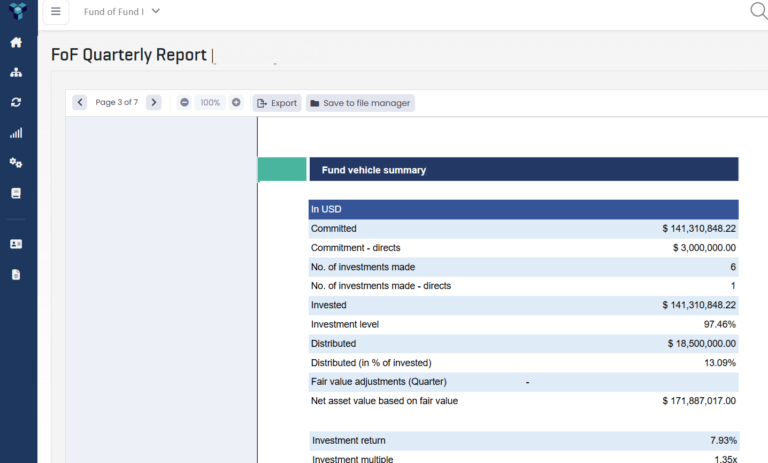

- Investee Fund-Level Analysis to assess fund-by-fund performance, cash flow movements, and capital commitments.

- Aggregate Exposure Tracking across all investee funds and direct investments, providing a complete view of portfolio summary, Gross IRR and MOIC.

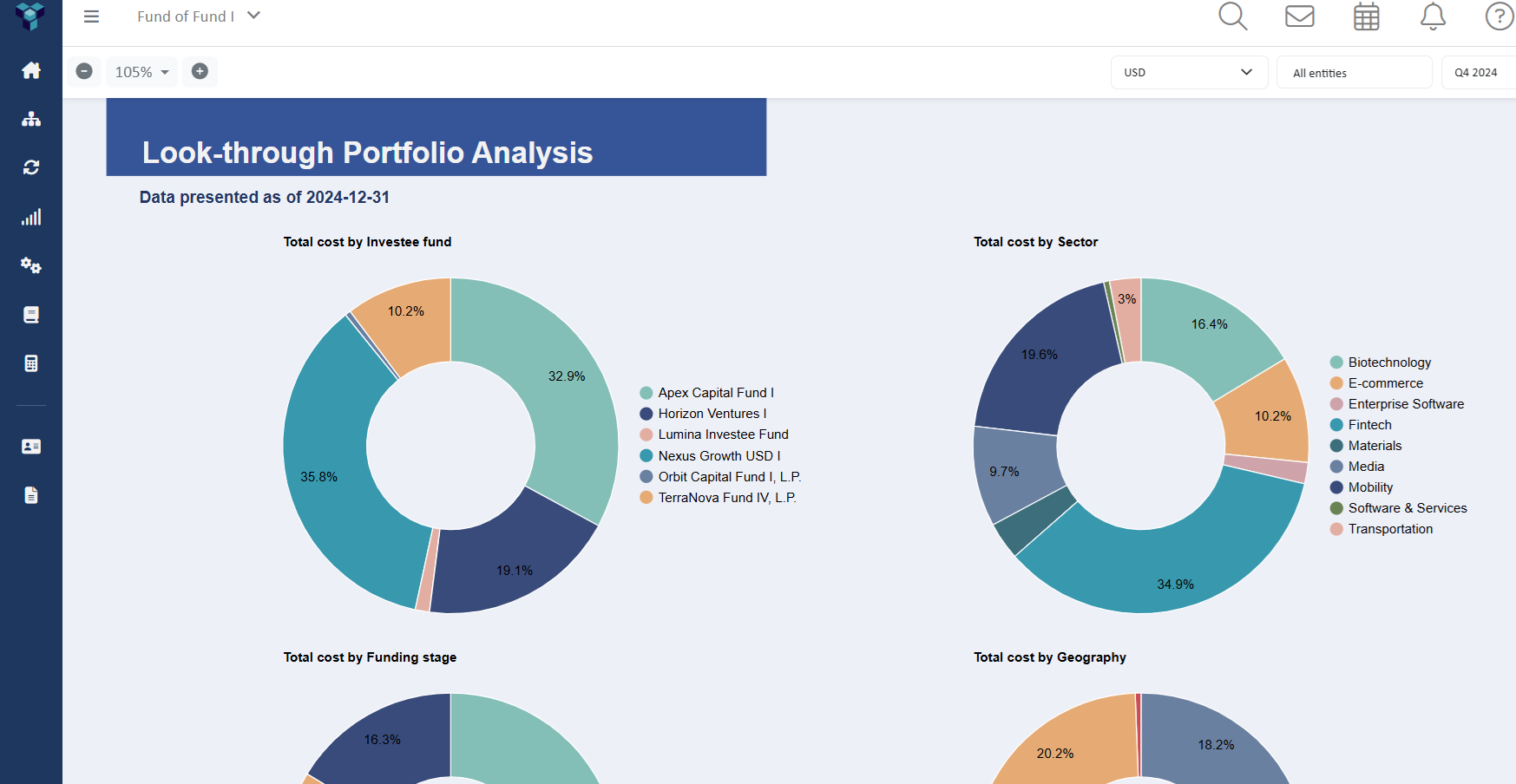

- Track LP Exposure to investee fund by strategy, geography and other attributes.

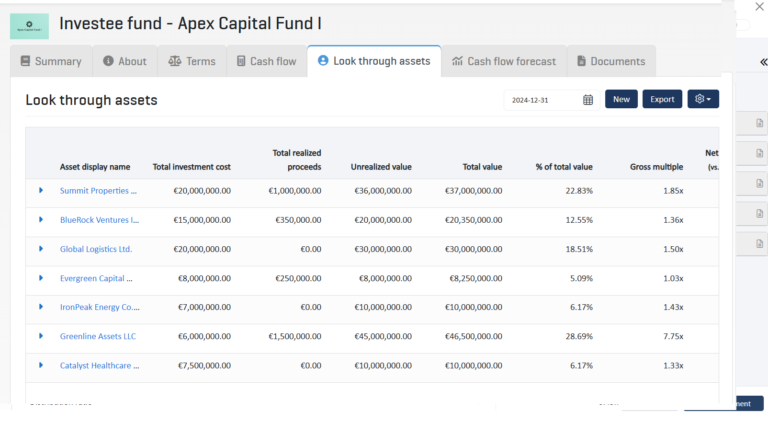

- Track Portfolio Company-Level Exposure, providing enhanced transparency beyond fund-level reporting.

- Monitor Look-Through Asset Performance, sector concentration, and risk distribution, ensuring detailed insights into underlying holdings.

- Generate Consolidated Reports for LPs and Stakeholders, offering institutional-grade reporting and compliance tracking.

use cases

Quantium’s data analytics and strategy solutions are top-notch. They provide deep insights that help us make quick, informed decisions and save us valuable time by automating tedious data analysis tasks. Highly recommended!

Julie Lee

Chief Financial Officer

AB Value

Send us your details via the form or e-mail us at enquiries@quantium.pe and our team will be in touch.