End-to-end loan management

Built for complex private debt operations

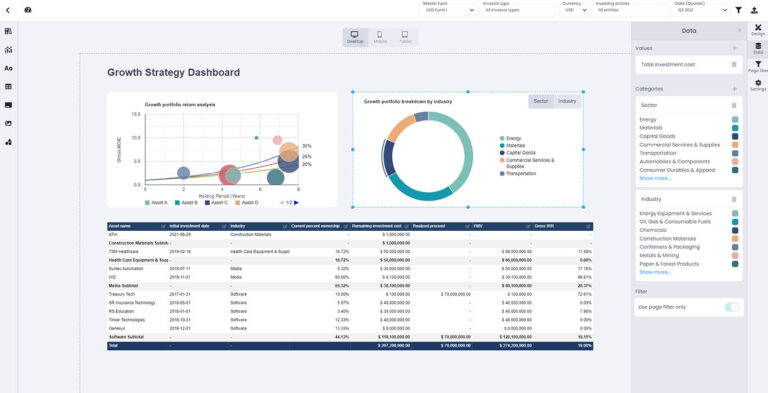

Private debt management poses unique operational challenges. Complex tasks like overseeing loan schedules, cash flows, and payment-in-kind (PIK) interest, amidst evolving scenarios such as equity warrants and restructurings require precise automation of loan amortization schedules.

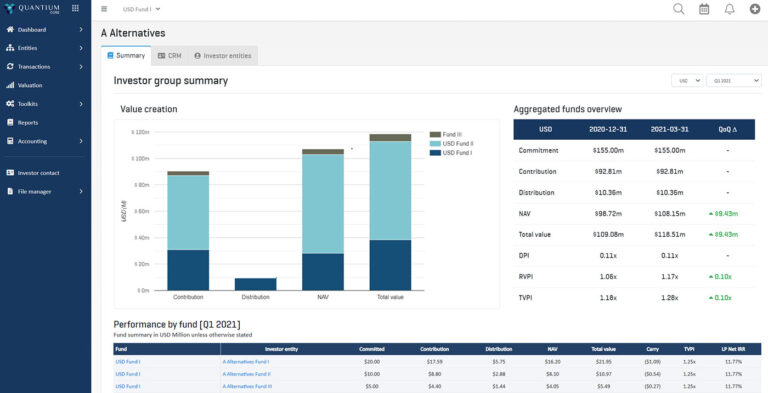

Effortlessly manage your private debt portfolios with Quantium’s integrated solution. Designed for precision and ease, Quantium enhances the efficiency of your private debt operations by streamlining loan tracking terms, debt schedules and disbursement dates, as well as automating complex IRR simulations and cashflow forecasts.

features

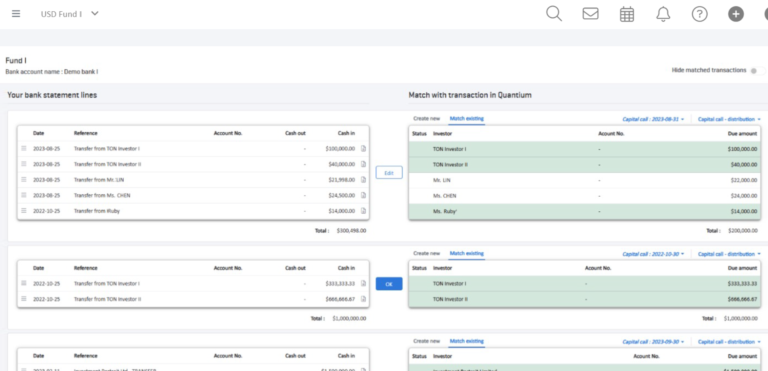

- Automate the creation and management of loan amortization schedules based on your loan agreements. Handle complex loan structures with ease, including interest-only periods and end-of-loan fees.

-

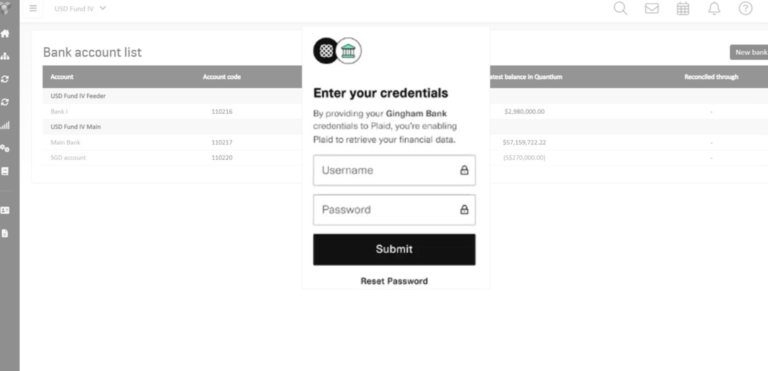

- Seamlessly manage loans with variable interest rates like SOFR and EURIBOR. Our system dynamically adjusts schedules based on rate changes via built-in APIs.

use cases

Quantium’s excellent customer service and account management post-implementation have been outstanding. We also appreciate Quantium’s collaborative approach – we can rely on their team to give us the best advice, with quick responsiveness. It’s clear that they prioritize their customers, making us feel valued and at the center of their focus.

Selim Hassani

Chief Operating Officer

Africinvest

Send us your details via the form or e-mail us at enquiries@quantium.pe and our team will be in touch.