Clear, tailored investor insights

turn portfolio data into a competitive advantage

Managing a private equity or venture portfolio isn’t just about collecting data—it’s about ensuring timeliness, completeness, and accuracy so your investment decisions are always backed by reliable, high-quality insights.

Quantium helps leading GPs transform fragmented, inconsistent portfolio data into a structured, audit-ready source of truth. Our platform centralizes key metrics, automates data collection, enforces validation rules, and delivers real-time portfolio analytics—all in one place.

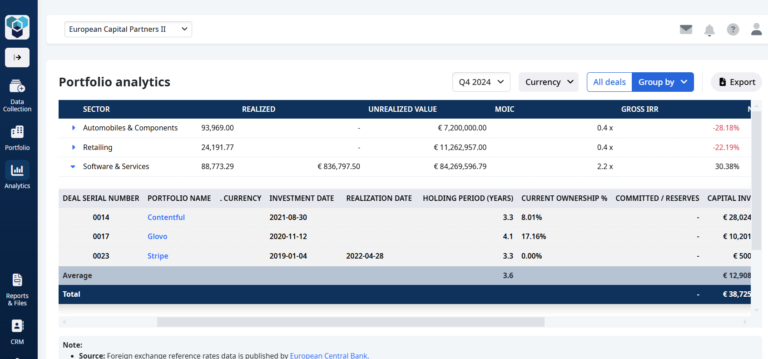

What once felt like a chaotic quarter-end scramble—piecing together Gross IRR calculations, portfolio one-pagers, and valuation updates—is now seamless, structured, and executed with precision.

features

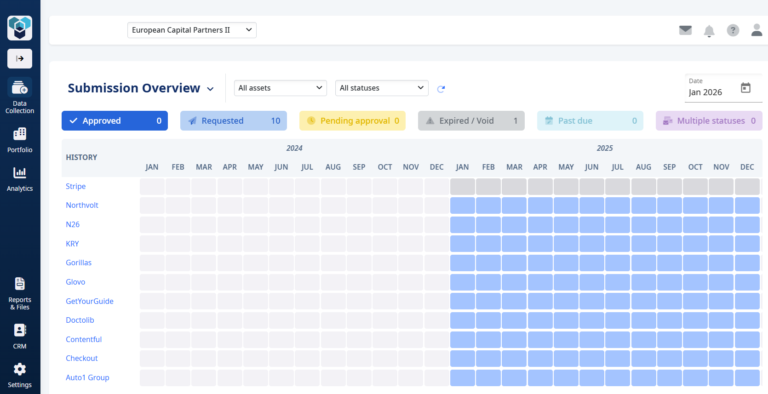

- Automated Data Collection: Set up schedules for automatically collecting key performance and operating metrics from portfolio companies. Send automated reminders to ensure timely submissions, cutting down on manual follow-ups.

- Error Handling & Submission Control: Manage voids, edits, and approvals within the platform, giving you full control over the submission process.

- Business Rules for Data Quality: Apply custom validation rules to ensure consistent and accurate data collection.

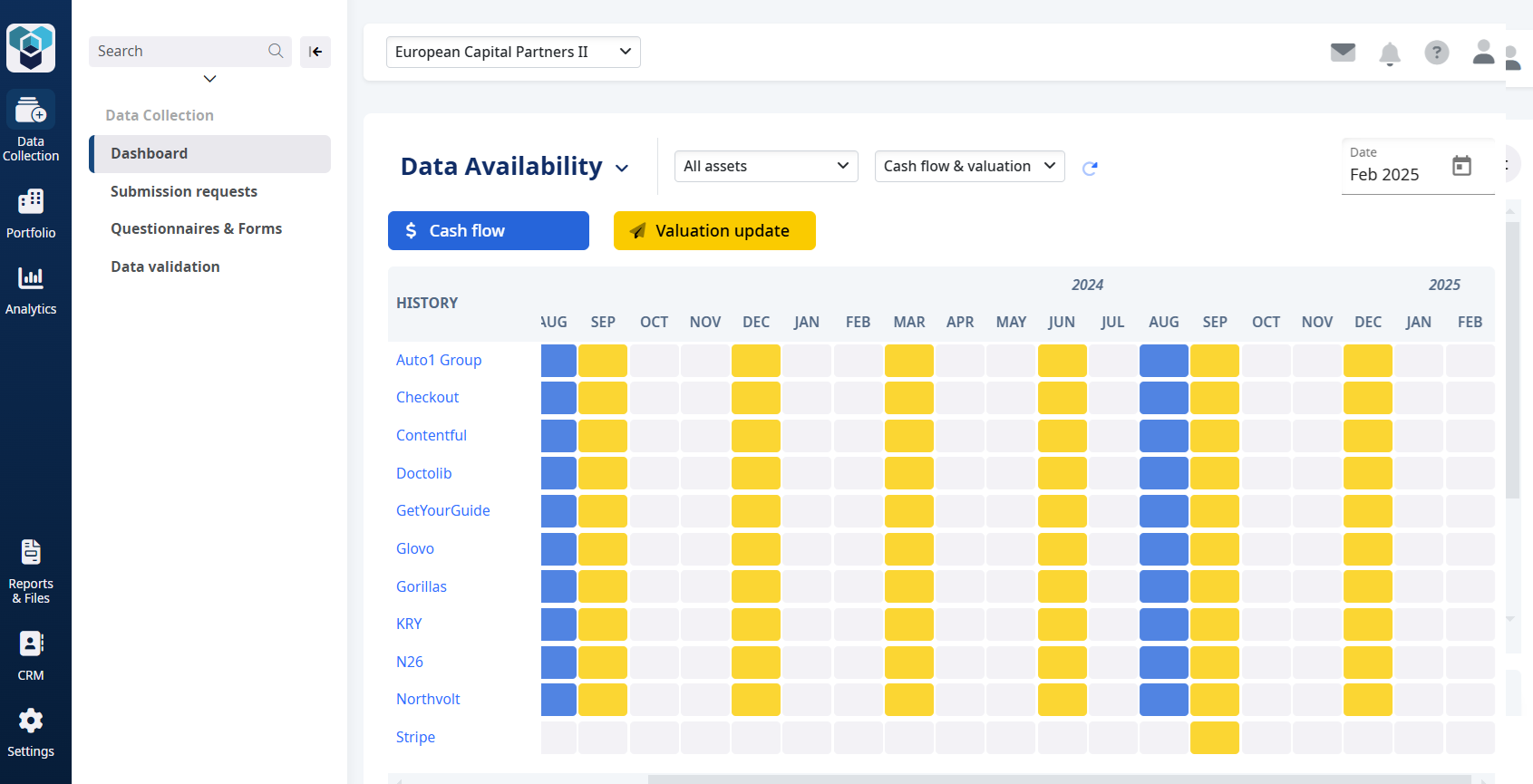

- Real-Time Monitoring: Track submission status, data availability, approvals, and deadlines across your portfolio with comprehensive dashboards.

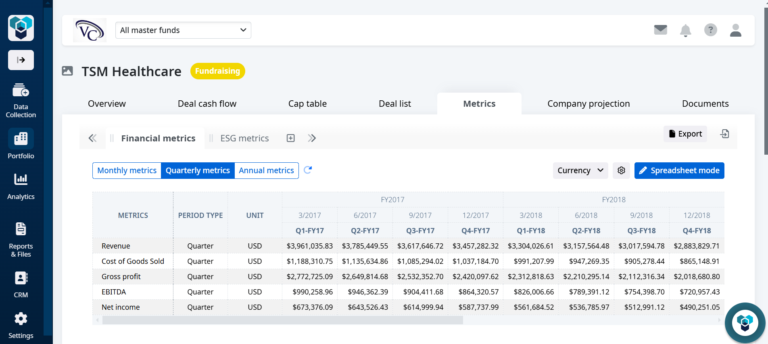

- Deal vs. Asset Level Tracking: Manage and differentiate between deal and asset-level data, including time-stamped and static values like changes in company names, board members, and executive teams.

- Cash Flow Tracking: Monitor cash flows and valuation updates across multiple funds, providing finance teams with real-time performance insights.

- Cap Table Management: Track investment rounds, ownership structures, and fully diluted shares.

- Deal Terms and Covenant Monitoring: Track deal terms, liquidation preferences, and monitor financial covenants for private debt managers to manage risk in real time.

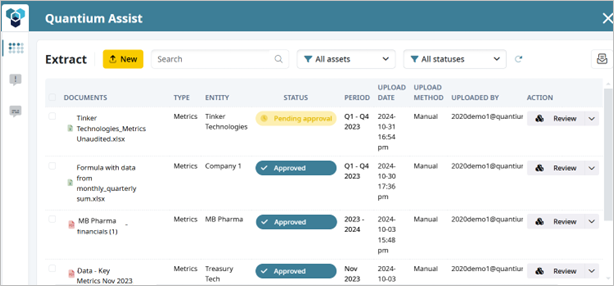

- AI Data Extraction: Leverage latest LLM to extract portfolio metrics from PDFs and Excel files submitted by your portfolio companies, allowing them to submit in their preferred formats while ensuring data consistency and flexibility.

- Approval Workflow: A maker-checker process ensures data accuracy and verification. The system supports AI-driven extraction and validation of operating metrics, financial metrics, and cap tables across multiple formats.

- Discrepancy Alerts: The system flags discrepancies between existing data and newly submitted metrics, providing alerts for financial and operational differences to ensure accuracy and accountability.

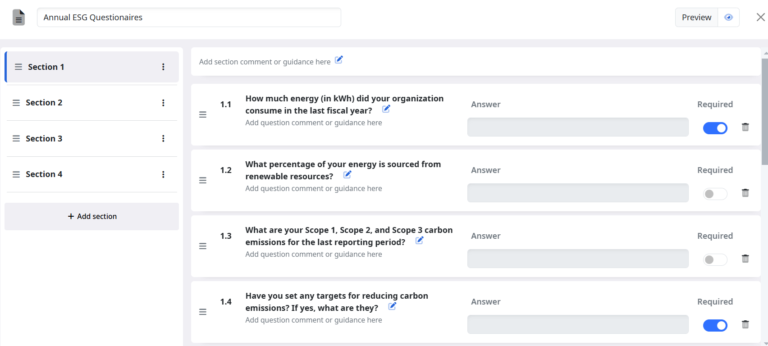

- ESG Metrics & Compliance Forms: Easily collect mandatory ESG metrics and compliance forms, including annual questionnaires, to ensure seamless and accurate reporting.

- Document Automation: Automate the creation and collection of required documents, customized to meet your specific data collection needs.

- Cash Flow and Gross IRR Analytics: Analyze cash flows and calculate Gross IRR at both the asset and deal levels across funds, giving you a comprehensive view of performance.

- Custom Attributes for Analysis: Use custom attributes to analyze returns based on unique factors like deal team or geography, offering deeper insights into performance drivers. Break down MOIC by categories such as sector and deal source to identify the key drivers of portfolio returns.

use cases

Quantium is an integral part of our operations, providing us with easy, accessible fund and portfolio data as well as actionable insights through their portfolio monitoring services. Their team has also been extremely helpful in customizing the platform to make sure it suits our firm’s specific needs.

Mahesha Subramaniam

Head of Investor Relations

Golden Gate Ventures

Send us your details via the form or e-mail us at enquiries@quantium.pe and our team will be in touch.