Trusted by leading asset managers

Total control of your data on an award-winning platform

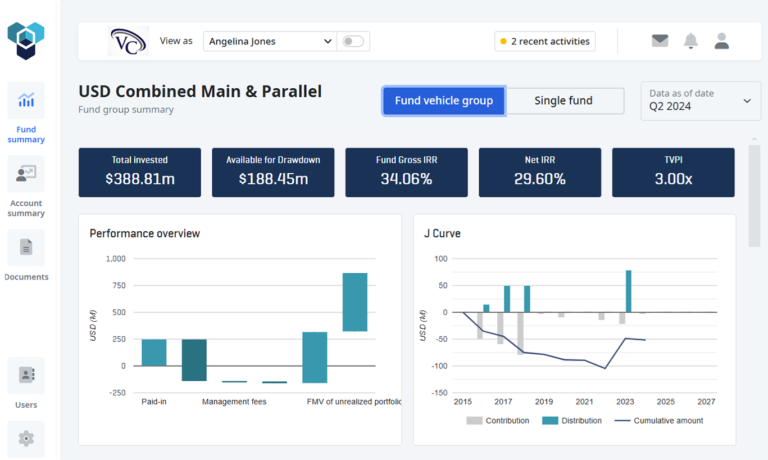

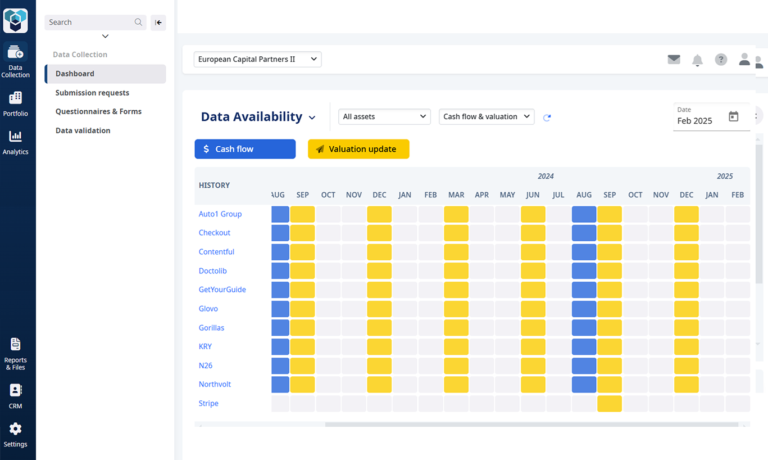

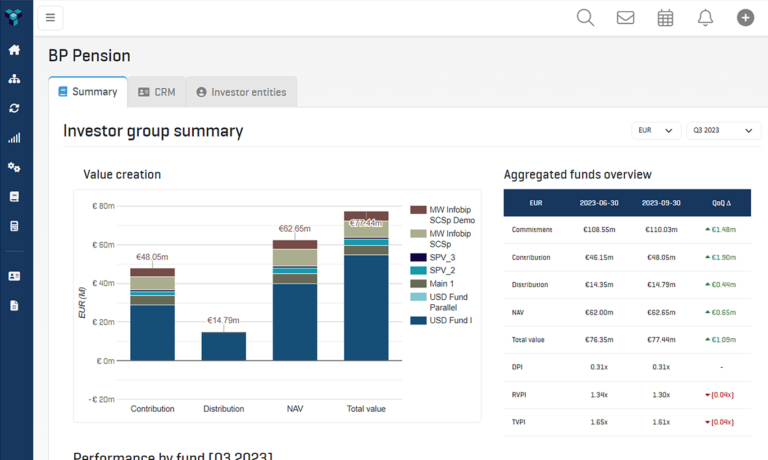

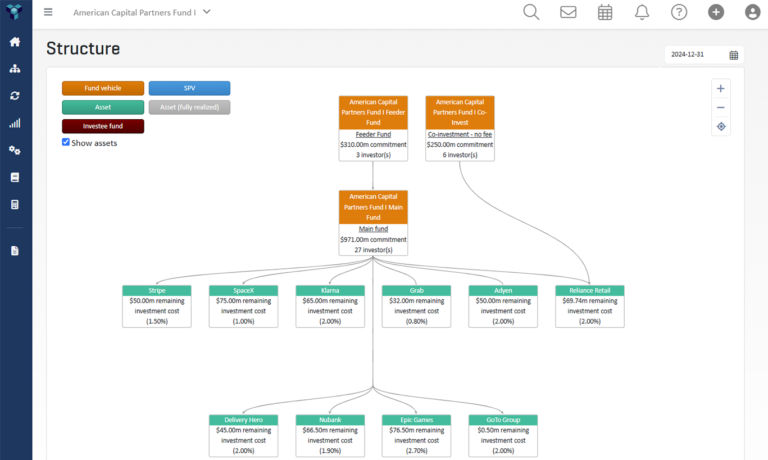

Quantium handles the complexity of your investor, fund and portfolio data so you don’t have to. We connect your entire fund operations – whether you need to manage your fund administrator outputs, legacy GL systems, or in-house fund accounting.

Get a unified, LP-optimised view across all your funds. Instant insights, without Excel stitching.

AUM

Quantium powers some of the most prominent private equity, private debt, venture capital and fund administrator firms, with over $100 billion AUM on our platform globally.

“Quantium’s excellent customer service and account management post-implementation have been outstanding. We also appreciate Quantium’s collaborative approach – we can rely on their team to give us the best advice, with quick responsiveness. It’s clear that they prioritize their customers, making us feel valued and at the center of their focus.”

“Quantium provides a highly effective and intuitive fund management platform. Its reporting tool, in particular, has been very helpful in streamlining data consolidation and various reporting generations with its flexible capabilities. We are also impressed by Quantium’s customer service teams with their focus on creating positive client experiences.”

“I am impressed by Quantium’s software. With extensive experience in implementing, migrating, and using top-tier PE tools in my roles as IT lead, fund administrator, and CFO at renowned German private equity firms, I found Quantium to be a thoughtfully designed, state-of-the-art system that meets the complex needs of private equity professionals.”

“Quantium gives us a single source of truth, with data that is clear, accessible, and up to date. The software is intuitive and feature-rich, and the flexible reporting tools have been very helpful in streamlining investor reporting. Beyond the system’s functionality, Quantium’s support has been excellent. They ensured a seamless transition from our previous solution and are responsive to any questions that come up. Overall, we have found Quantium to be an effective fund management solution and have had very positive experiences working with their team.”

“Quantium has transformed our fund management operations. We now have an effective means of tracking and presenting NAV and other key metrics, and our staff have provided excellent feedback on the usability and ease of use of the investor portal. We’ve been very pleased with the level of support we’ve received from the Quantium team, which has been very impressive and has effectively supported the implementation and ongoing improvement of our use of the platform.”

“Our team is no longer slowed down by endless spreadsheets and complex manual calculations. Quantium has truly digitised our previously manual investment operations by automating the majority of these processes. We can analyse investment information with ease, generate reports in a few clicks, and access our investor information instantly whenever we need it.”

“With Quantium, we have a single source of truth for our fund management workflows, including shadow accounting to cross-check our fund admin’s data and post-investment management. Quantium has also automated our investor reporting, which allows our team to focus on high-value tasks. We are extremely impressed with the smooth implementation process at Quantium as well as the system itself.”

“Quantium’s data analytics and strategy solutions are top-notch. They provide deep insights that help us make quick, informed decisions and save us valuable time by automating tedious data analysis tasks. Highly recommended!”

“From the first point of contact and throughout the implementation process, the Quantium team was exceptionally hands-on, proactive and agile. They impressed with their thoughtful questions about what ACE Alternatives was hoping to achieve – they know their business inside and out.”

“Quantium is an integral part of Golden Gate’s operations, providing us with easy, accessible fund and portfolio data as well as actionable insights through their portfolio monitoring services. Their team’s expertise in how LPs monitor and evaluate investments makes them an ideal operating partner for high-performing venture firms. The team has also been extremely helpful in customizing the platform to make sure it suits the specific needs of our firm.”