Stand out from the competition

An award-winning client experience

Quantium offers fund administrators a robust platform that unifies fund accounting, transaction / cash flows records as well as investor allocation in a single location. With integrated technology that covers portfolio monitoring as well as Business Intelligence analytics, our software enables fund administrators to integrate deeper into their client workflows and provides value-added services like real-time portfolio monitoring, customized ESG reporting, and tailored LP reports.

Whether you are an established fund administrator looking to enhance your existing tech stack or emerging fund administrators searching for the best-in-class modern solutions, Quantium helps you enhance your service offerings and acquire and retain clients more effectively.

features

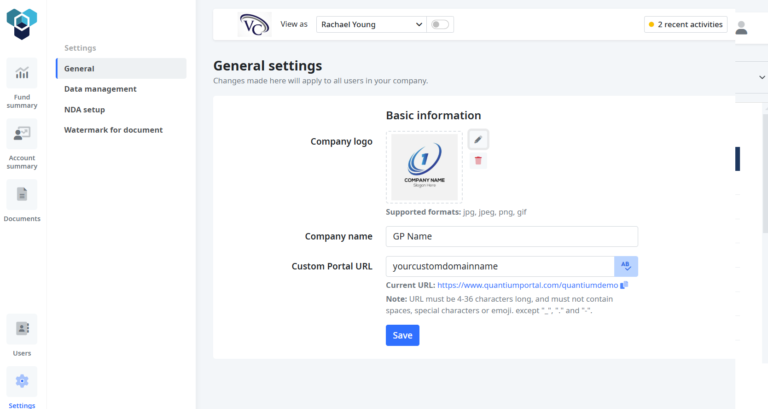

- Your Own Branded Landing Page, where you can easily manage all your clients on a single, secure platform – with different access rights configured across your team.

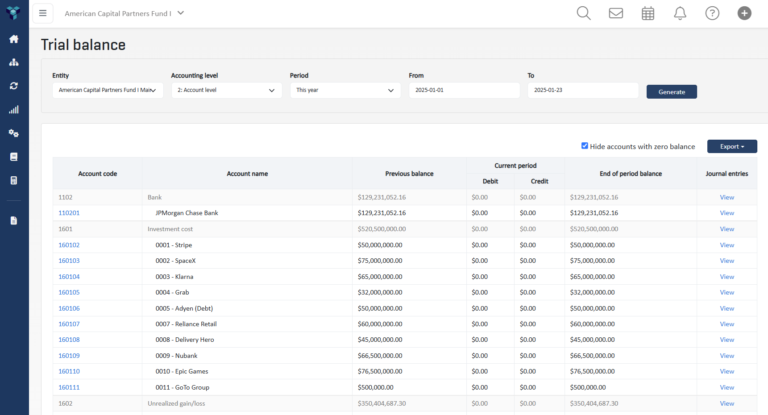

- Dual-Sided Accounting: Enhance efficiency with powerful dual-sided accounting, featuring intuitive event-driven automations tailored for both direct and fund investments.

- Workflow Automation: Automate key fund workflows, such as multiple closings and transfers, effortlessly.

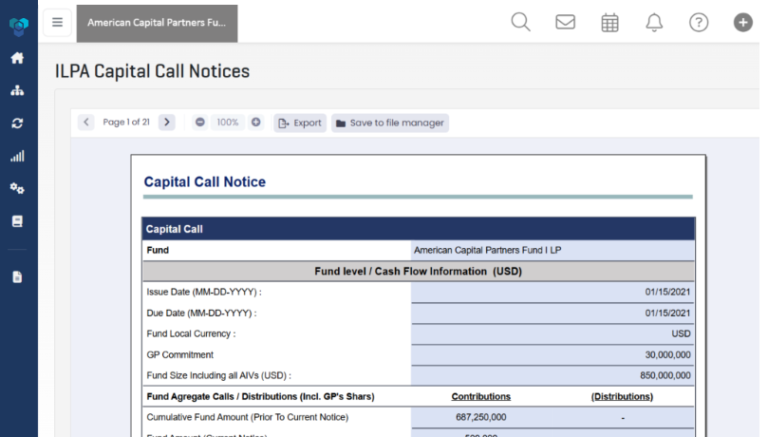

- Reporting Automation: Automate key fund workflows, such as multiple closings and transfers, effortlessly. From standard ILPA report templates to configurable PCAP to meet your specific needs, our highly configurable reporting via business and analytics tools meet a diverse range of client requirements.

- Waterfall Automation: Automate simple to complex waterfall terms (European/deal-by-deal), with configurable return types, catch-up policies and more.

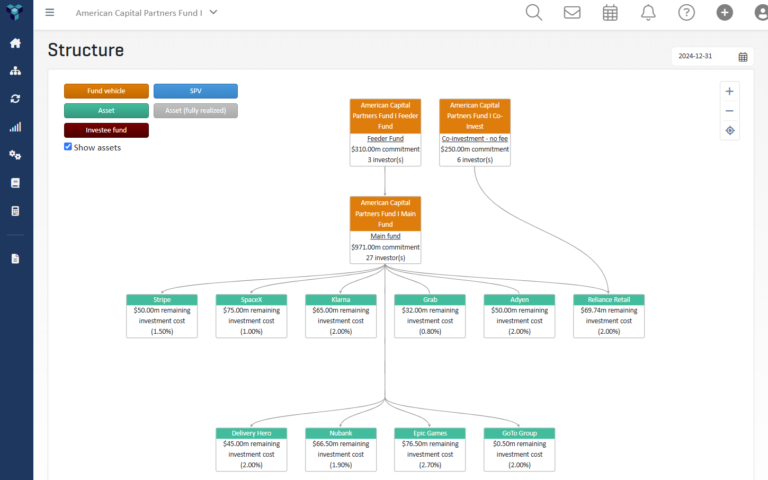

- Set Up and Visualize entity structures of any level of complexity. Handle intricate fund and entity configurations with ease.

- Automate Equity Pick-Up for feeder and child structures automatically.

use cases

From the first point of contact and throughout the implementation process, the Quantium team was exceptionally hands-on, proactive and agile. They impressed with their thoughtful questions about what ACE Alternatives was hoping to achieve – they know their business inside and out.

Matias Collan

Managing Director

ACE Alternatives

Send us your details via the form or e-mail us at enquiries@quantium.pe and our team will be in touch.